georgia ad valorem tax exemption form family member

Georgia Tax Center Help Individual Income Taxes Register New Business. PT-471 Service Members Affidavit For Exemption of Ad Valorem Taxes For Motor Vehicles.

Covid 19 Cbsa Reminds Recreational Boaters That Now Is Not The Time To Be Crossing The Border For Discretionary Reasons Canada Ca

Ad Get Access to the Largest Online Library of Legal Forms for Any State.

. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Property Tax Exemptions for Disabled Veterans by State Alabama Ad Valorem Tax Exemption Tax Break for Specially Adapted Housing for Veterans. Georgia ad valorem tax exemption form family member Home Uncategorized georgia ad valorem tax exemption form family member claremont nh.

Homebase powerschool parent login. Georgia ad valorem tax exemption form family member. T-146 Georgia IRP Exemption to State and Local Ad ValoremTitle Ad Valorem Tax Fee Application.

Characteristics of type a personality. T-146 Rev 0615 Georgia Department of Revenue Motor Vehicle Division International Registration Plan IRP GEORGIA IRP EXEMPTION TO STATE AND LOCAL AD VALOREM TITLE AD VALOREM TAX FEE APPLICATION This form must be complete legibly printed and attached to application for the Certificate of Title. ApplicantMotor Carrier attests that Georgia sales and use tax is paid unless exempt under Article 8.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Ad Download Or Email Form ST-5 More Fillable Forms Register and Subscribe Now. This form must be completed in its entirety legibly printed in blue or black ink or typed and submitted along with the.

Georgia Department of Revenue SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES Form PT 471 122010 I _____ _____ Full Legal Name Service Members Number do hereby solemnly swear or affirm that. Pelicans panama city beach. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Any Ad Valorem Tax due on the above items is payable to the taxing authority of my home countrystate listed above. Georgia ad valorem tax exemption form family member. Attach a copy of paid receipt if applicable and copy of LES.

Facebook page opens in new window. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. The actual filing of documents is the veterans responsibility.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000. Inherited between persons who are immediate family members. This tax is based on the value of the vehicle.

Georgia Trucking Portal Forms Alcohol Tobacco Alcohol Tobacco Enforcement Excise Taxes Online Services. Void After 60 Days Void If Altered. Not limited to veterans only the ad valorem tax break exempts qualified applicants from ad valorem taxation of a home and an adjacent 160 acres for those who are permanently and totally disabled or who is 65 years of.

Download fax print or fill online Form ST-5 more subscribe now. Ad Complete Tax Forms Online or Print Official Tax Documents. Continue to pay annual ad valorem tax on.

How does TAVT impact vehicles that are leased. Check only if. How to submit this form.

If you the former owner have not paid the TAVT and are paying annual ad valorem tax on the vehicle your immediate relative has two options. For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT depends on whether you as the former owner of the vehicle have already paid the TAVT. Justia US Law US Codes and Statutes Georgia Code 2014 Georgia Code Title 48 - REVENUE AND TAXATION Chapter 5 - AD VALOREM TAXATION OF PROPERTY Article 2 - PROPERTY TAX EXEMPTIONS AND DEFERRAL Part 1 - TAX EXEMPTIONS 48-5-41 -.

Spouse Parent Child Sibling Grandparent Grandchild. This form is to be used by a Motor Carrier to apply for exemption from Title Ad Valorem Tax. Any alteration or correction voids this form.

TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations Georgia Trucking Portal. Georgia Department of Revenue - Motor Vehicle Division. Tax Credits Motor Vehicles Online Services Titles and Registration TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations Georgia Trucking Portal Forms Alcohol Tobacco Alcohol.

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Georgia Tax Center Help Individual Income Taxes Register New Business. Vehicles purchased on or after March 1 2013.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. The family member who is titling the vehicle is subject to a 05 title ad valorem tax. The tax must be paid at the time of sale by Georgia residents or within six months of.

The dealership is responsible for paying the title ad valorem tax and may include this cost in the. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Family transfer - Form MV-16 Affidavit.

I am aware that I must be stationed in the state of Georgia and live in the State of Georgia to quality for this exemption. I understand that the above referenced vehicle is currently under the Ad Valorem Tax System and I choose to remain in the Ad Valorem Tax System.

Foreign Inheritance Taxes What Do You Need To Declare Greenback Expat Tax Services

.png)

Gifting A Car In Ontario Everything You Need To Know Clutch Blog

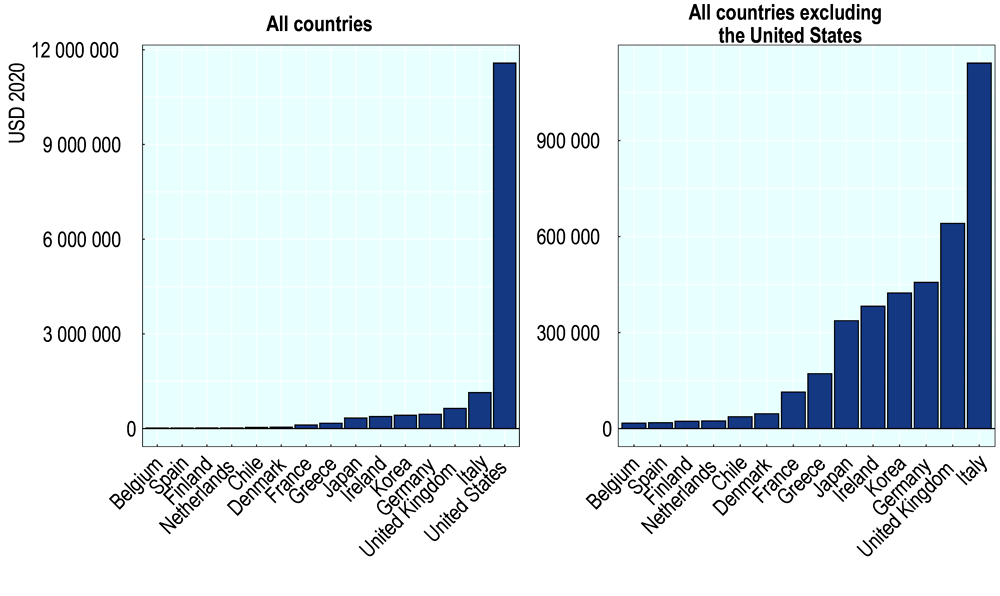

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Zillow Has 260 Homes For Sale In Berea Ky View Listing Photos Review Sales History And Use Our Detailed Real Estate Filters To Find The Tremont Berea Zillow

Tax Exemption Colorado Mesa University

Download Partnership Agreement Style Template For Free At Within Supplemental Agreement Template 10 Professional Temp Investing Agreement Sponsorship Letter

Whatif The Bus Is Late I Can Relate To This Because Once The Bus Was Late And I Decided To Go Home And Once I Stepped On My Man

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Requirements For Tax Exemption Tax Exempt Organizations

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Gifting A Car In Ontario Everything You Need To Know Clutch Blog

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Affordability And Livability Is In Our Hands Build Blog Affordable Housing Affordable House Plans Urban Design Concept

What Is A Homestead Exemption And How Does It Work Lendingtree

All The Nassau County Property Tax Exemptions You Should Know About

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)