charitable gift annuity tax reporting

The terms registered charity and qualified donee are defined in subsections 2481 and 14911 respectively. We adhere to ethical journalism practices including presenting honest unbiased information that follows Associated Press style guidelines and reporting facts from reliable attributed sources.

The term of the trust is.

. Charitable contributions to qualified tax-exempt organizations do not need to be disclosed on a gift tax return unless the taxpayer otherwise has a reporting requirement for other taxable gifts. In a charitable remainder trust the donor transfers assets to an annuity trust or unitrust. A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts.

Proof of Charitable Contributions. Grantor Retained Annuity Trusts GRATs Grantor retained annuity trust GRATs last for a term of years and provide a periodic payment to the grantor of the trust during the term. In a unitrust the payment is a percentage of the value of the trust as valued each year.

For 2019 the annual exclusion for a gift of a present interest is 15000. Based on the amount of. It can also lower your income tax expense.

For a child who must file a tax return Form 8615 Tax for Certain Children Who Have Unearned Income is used to calculate the childs tax and must be attached to the childs tax return. Charitable giving can help those in need or support a worthy cause. Our objective is to deliver the most comprehensive.

Depending on your tax bracket the type of asset and the type of charity the charitable deduction can reduce your income taxes by 10 percent 20 percent 30 percent or even more. Gift trust are typically used in making gift for children grandchildren nieces nephews grandnieces and grandnephews and grandnephews. For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes.

Substantiation required by the Internal Revenue Service for a taxpayer to claim a donation of money property or financial assets as an itemizable federal income. Under the Coronavirus Aid Relief and Economic Security CARES Act you can deduct up to 100 percent of your charitable cash contributions to qualifying charities made in the 2020 calendar year. Child Files A Tax Return.

183 A donation tax credit can be claimed in respect of the eligible amount of a charitable gift made to a registered charity or other qualified donee. The NIIT is a 38 additional. The term total charitable gifts is defined in subsection 11811.

Not all charities are DGRs. Rounding Off to Whole Dollars. Bail Bond Agent General Bail Bond Agent and Surety Recovery Agent Affidavit of Exam Proctor MO 375-0108 Bail Bond Agent General Bail Bond Agent and Surety Recovery Agent Continuing Education Certificate of Course Completion MO 375-0106 Bail.

A child whose tax is figured on Form 8615 may be subject to the net investment income tax NIIT. The trust pays the donor or another beneficiary a certain amount each year for a specified period. For a sample form of a trust that meets the requirements of a testamentary charitable lead annuity trust see Rev.

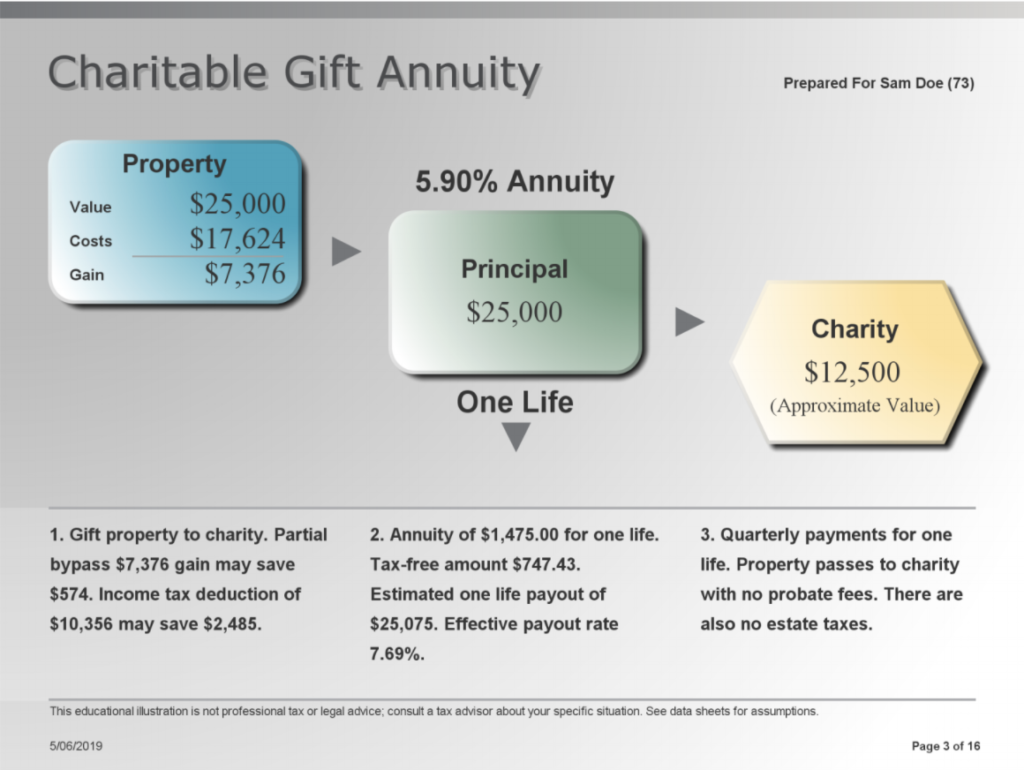

If in connection with a transfer to or for the use of an organization described in subsection c such organization incurs an obligation to pay a charitable gift annuity as defined in section 501m and such organization purchases any annuity contract to fund such obligation persons receiving payments under the charitable gift annuity shall not be treated for purposes of. At the end the trust is allocated. In an annuity trust the payment is a specified dollar amount.

Charitable Gift Annuity Notification form MO 375-0991 Continuing education forms Bail Bond. If you do round dollars you must round all amounts. Eligible donations of cash as.

You may round off cents to whole dollars on your return and attached statements. In his 1969 tax return he reported giving each child Fred Trumps 1969 federal gift tax return Read document 15 percent of Midland Associates.

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Immediate University Of Virginia School Of Law

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

Charitable Gift Annuity Thinktv

How Do Charitable Gift Annuities Work Lisbdnet Com

Gifts That Provide Income Maine Organic Farmers And Gardeners

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

How Do I Deduct A Gift Annuity To A Charity

Charitable Gift Annuities Development Alumni Relations

City Of Hope Planned Giving Fall Annuity

Life Income Plans University Of Maine Foundation

Gift Annuities Catholic Charities Usa

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center